48+ how does paying extra principal affect mortgage

Heres how that extra payment. Web Making just one extra payment towards the principal of your mortgage a year can help take years off the life of your loan.

A Little Known Strategy For Cutting Mortgage Payments Mortgages The New York Times

With the same 6 interest rate youd end up paying 2273 instead.

. If you prepay 1000 on your. Web If you prepay your mortgage you reduce the principal balance reducing the interest due next month and every month forward. Web If you have a 30-year 250000 mortgage with a 5 percent interest rate you will pay 134205 each month in principal and interest alone.

Web A principal-only mortgage payment also known as an additional principal payment is a supplementary payment applied directly to your mortgage loan. Ad View a Complete Amortization Payment Schedule and How Much You Could Save On Your Mortgage. Before you make an extra mortgage payment keep in mind that not all mortgages have a tax-deductible interest.

Web If you make your regular payments your monthly mortgage principal and interest payment will be 955 for the life of the loan for a total of 343739 of which 143739 is. Web Heres how it works. Web You can make additional payments applied to your principal at the time your mortgage payment is normally due or earlier.

Ad Finance raw land with fixed or variable rates flexible payments and no max loan amount. Get an idea of your estimated payments or loan possibilities. Time Frame The amount that an extra.

So most of your monthly payment goes to pay the interest and. Increasing Mortgage Payments Could Help You Save on Interest. In the beginning you owe more interest because your loan balance is still high.

Because your balance is being paid. Or you can do so at more frequent. Web Simply paying a little more towards the principal each month will allow the borrower to pay off the mortgage early.

Web Lets start with a simple scenario where you add just 10 a month in extra payment to principal. You will pay 23313389 in. This method reduces the total amount of interest you.

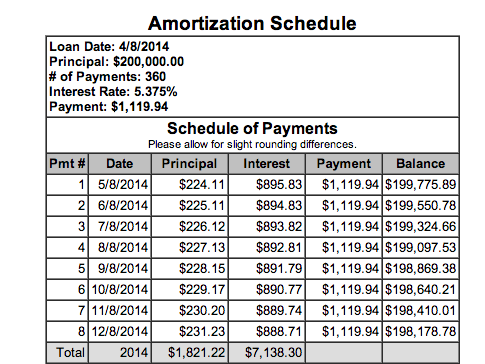

Just paying an additional 100 per month. Web Making additional principal payments will also shorten the length of your mortgage term and allow you to build equity faster. Web This process of balancing out the principal and interest each month to keep your payments at a steady amount is called amortization.

Web Disadvantages of Paying Down Your Mortgage. Assuming youve got a 100000 loan amount set at 4 on a 30. Web So instead lets imagine you increased your mortgage payment by 112th 175 each month.

Web which is just over 348. Try our mortgage calculator. Web For example maybe you get a 5000 bonus every May for your annual work anniversary and you put that 5000 straight toward your principal.

This means that every extra dollar you pay now will save you 248 348 1 over the lifetime of the mortgage.

How To Pay Off A 30 Year Home Mortgage In 5 7 Years Youtube

In His Latest Book Tony Says Prepay Your Next Month S Principal And You Could Pay Off A 30 Year Mortgage In 15 Years In Many Cases Is This True Quora

Early Mortgage Repayment Calculator Paying Extra On Your Home Loan With Bi Weekly Payments

Early Mortgage Repayment Calculator Paying Extra On Your Home Loan With Bi Weekly Payments

Which Mortgage Is Better 15 Vs 30 Year Home Loan Comparison Calculator

The Power Of Extra Mortgage Payments

Sterling September 2019 European P2p Lending Portfolio Update P2p Millionaire

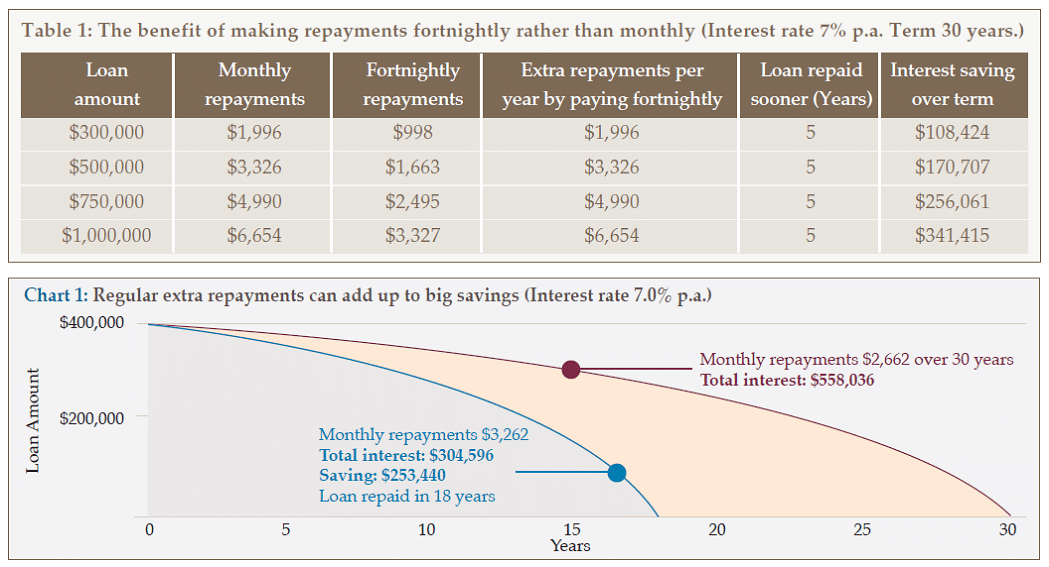

Mortgage Insights Making Extra Repayments Can Make A Big Difference Hta

Mortgage Fundamentals An Illustrated Tutorial

Is Prepaying Your Mortgage A Good Decision Bankrate

Mortgage Payoff Calculator Accelerated Mortgage Payment Calculator With Extra Payments

When Do Mortgage Payments Start It Depends When You Close

Extra Payment Calculator Is It The Right Thing To Do

What Your Mortgage Interest Rate Really Means Money Under 30

Should You Make Extra Mortgage Payments Compare Pros Cons

Should You Pay Off Your Mortgage Or Invest The Cash

Should You Make Extra Mortgage Payments Compare Pros Cons